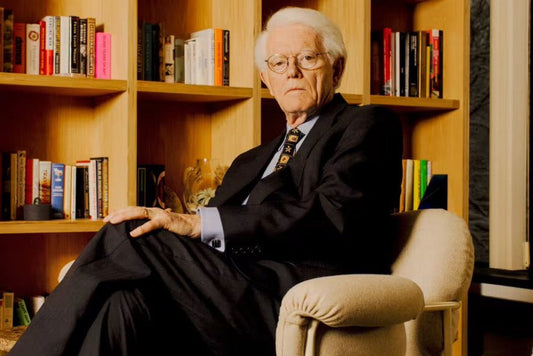

Malaysia’s Budget 2023 to be expansive, but not overly so as govt needs firepower for rockier times ahead — World Bank economist

KUALA LUMPUR (Sept 30): Malaysia’s upcoming Budget 2023 is likely to be expansive, but it should not be overly so due to fiscal limitations, according to the World Bank's lead economist for Malaysia.

On Friday (Sept 30), Apurva Sanghi wrote on Twitter that the upcoming budget to be tabled on Oct 7 will be expansive in view of the looming election, a lagging post-pandemic B40 recovery, and the risk of increased flooding.

He also noted that the country’s need to bolster its healthcare system and support the 12th Malaysia Plan will also add to the costs of the budget.

“But it can’t be overly expansive (and expensive) because fewer support measures are now required post-pandemic, the [government’s] fiscal space remains narrow, and [it] needs to save some firepower for rockier times ahead,” he added.

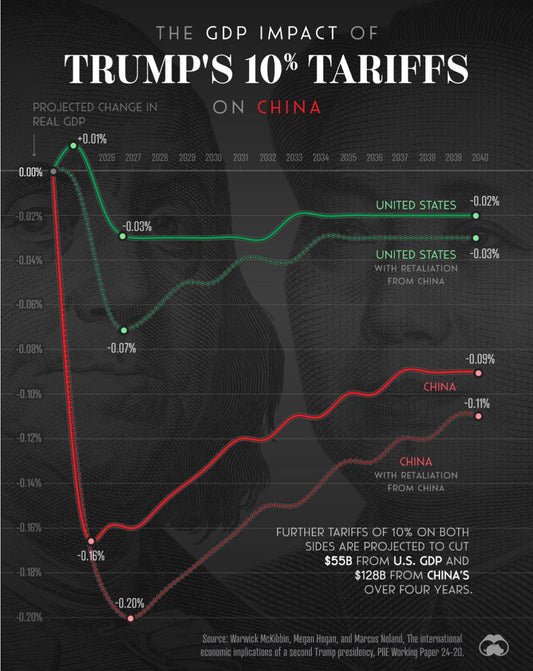

He noted that while the World Bank revised Malaysia’s 2022 GDP forecast upwards to 6.4% from 5.5%, the international financial institution also downgraded the nation’s forecast for 2023 from 4.5% to 4.2%.

“The bump in Malaysia is mostly due to cyclical factors (high commodity, and electrical and electronics (E&E) prices) as well as one-off factors — such as EPF withdrawals and the economy opening up fully.

“[However,] many structural constraints still remain. Our latest survey finds that 70% of lower-income households can’t even meet monthly basic needs — more than 60% of these households reported having no savings.

“Food inflation was above 7% and Malaysian women remain held back from the labour force. Overall productivity growth remains mixed,” he said.

Apurva warned that focusing on just headline growth figures will lull the nation into a false sense of complacency, and added that it matters how growth is generated and shared.

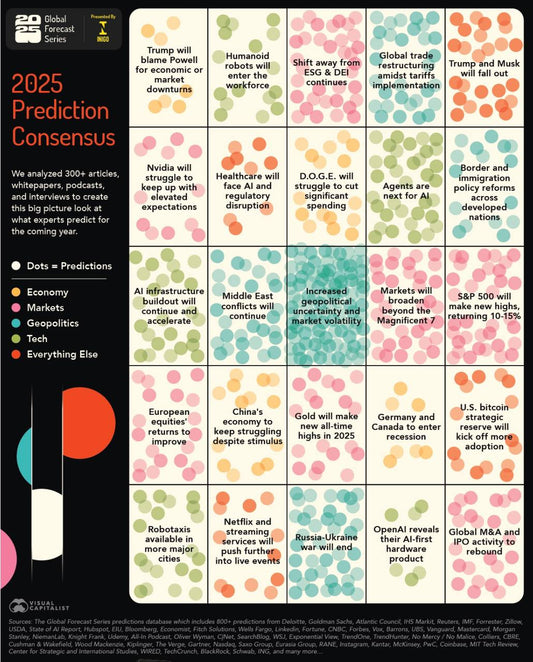

Meanwhile, the economist opined that Malaysia’s semiconductor industry, which is benefiting from the US and China trade war, is to act as a silver lining for Malaysia when put against the backdrop of the world economy likely to edge towards a recession in 2023.

“But talent crunch is hitting the tech industry and economy hard… five out of six occupations that require advanced digital skills still remain on the government’s ‘Critical Occupation List’ even after six years.

“Malaysia needs to rebalance importing low skills and exporting its high skills,” he emphasised.

As for the ringgit losing its footing against the US dollar, Apurva noted that other major currencies have fallen even lower.

Over the past 52-week period, the ringgit has depreciated by 10.85%, while the euro fell 15.31%, the British pound dropped 17.57% and the Japanese yen tumbled 29.96%, according to Bloomberg.

Apurva noted that while Malaysia’s largest trading partners are China and Singapore, around 80% of the nation’s exports and imports are invoiced in the greenback.

“In contrast, only between 4% [and] 5% of Malaysian trade happens in the ringgit,” he said.