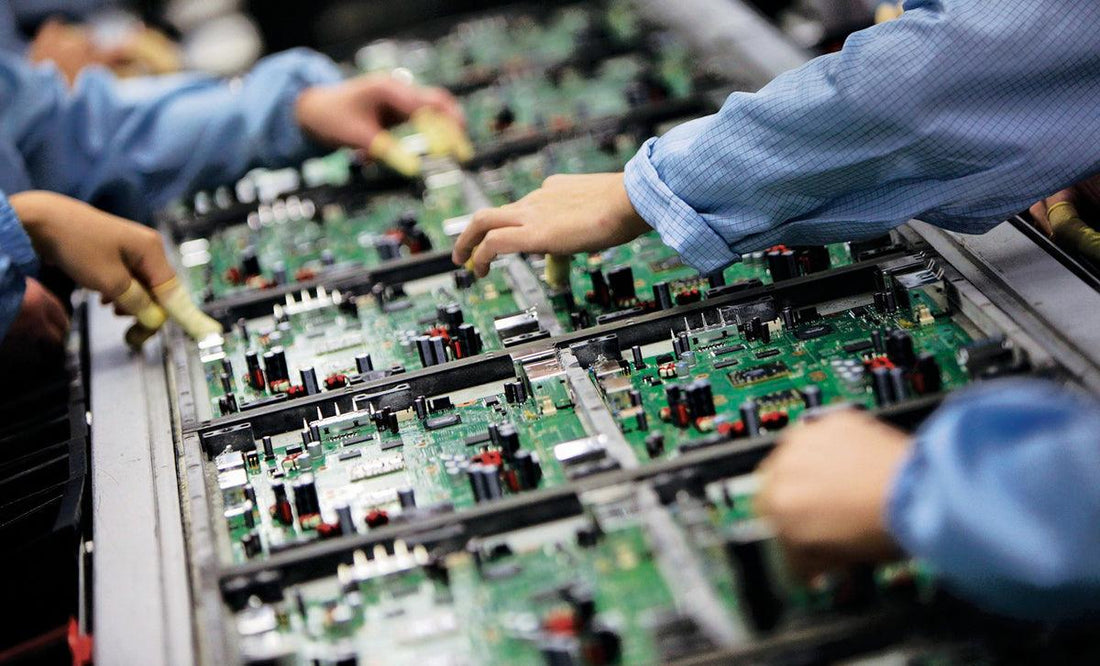

Concerns over economic slowdown weighs on electronics manufacturing

KUALA LUMPUR: Slowing export growth and fears of a global recession are raising concern over softening demand in the country's electronics manufacturing sector.

There have been softer macro readings in recent data released by the National Statistics Department including lower year-on-year (y-o-y) manufacturing production growth of 6.5% in April, as compared with 6.9% in March.

There have been softer macro readings in recent data released by the National Statistics Department including lower year-on-year (y-o-y) manufacturing production growth of 6.5% in April, as compared with 6.9% in March.

On a monthly seasonally adjusted basis, manufacturing recorded a 0.3% y-o-y contraction.

According to Hong Leong Investment Bank (HLIB) Research, the moderation in manufacturing production mainly stemmed from the slowdown in the export-oriented sector, consistent with softer exports growth during the month.

"Weaker macro readings from IPI, manufacturing PMI, slower export growth to US and EU coupled with contraction in US consumer’s discretionary spending provide an indicator of slowing down for our electronics manufacturers," said HLIB.

The research firm also noted US customers have cut back on discretionary spending, with retail sales in electronics and appliance stores in May contracting 1.8%.

HLIB downgraded its sector recommendation to "neutral". It maintained its buy call on top sector pick VS Industry Bhd (TP: RM1.14) and Uchi Technologies Bhd (TP: RM3.30) and reiterated "sell" on Panasonic Manufacturing Malaysia Bhd (TP: RM22.33).

On a brighter note, HLIB said there has been some improvement in the labour shortage situation, citing VS Industry's recent intake of 1,100 foreign workers following the reopening of borders.

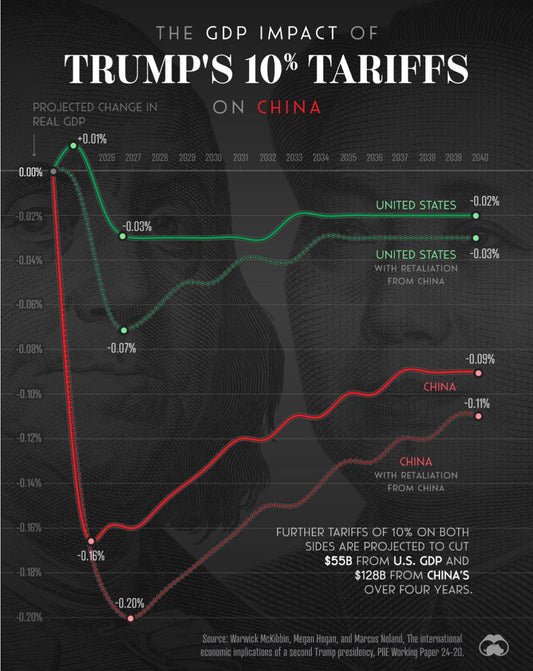

HLIB is also optimistic Malaysia will continue to benefit from the US-China trade war as local manufacturers secure more outsourcing jobs.

"From our channel checks, our local EMS players have been getting requests for quotations buoyed by increasing order diversions," it said.

Source: The Star